Did you get a call from someone posing as a bank representative, claiming there is suspicious activity on your account? Or maybe you received a tech support call, telling you that your computer has a virus and is requesting remote access to fix the problem? That’s most likely a “vishing” attempt, a type of social engineering attack that’s currently on the rise.

What is vishing?

Vishing, which is short for “voice phishing”, is a scam where criminals use phone calls to trick people into giving out personal or financial information. These scammers often pretend to be from trusted organizations like banks, tech support, or government agencies. They create a sense of urgency, convincing victims to act quickly to resolve an issue or avoid a penalty.

What happens is that these attackers use tactics like spoofing caller ID to make it seem like they are calling from a legitimate number. They might ask for sensitive information such as social security numbers, passwords, or credit card details. Vishing can occur via live calls or through automated voice messages, known as robocalls.

What is the difference between vishing, smishing, and phishing?

Phishing, smishing, and vishing are all scams where criminals try to steal personal information. The difference lies in the methods that they use:

Phishing

This involves sending fake emails that look like they come from trusted sources. These emails often contain links to fake websites designed to steal login credentials, financial information, or other sensitive data.

For example, you might receive an email claiming to be from your bank, asking you to verify your account details. When you click the link, you’re taken to a website that looks legitimate but is actually controlled by scammers.

Read more: What Are Phishing Emails and How Do You Stop Them?

Smishing

This is similar to phishing but it uses SMS or text messages instead of emails. The term is a combination of:

- SMS or Short Message Service

- Phishing

Scammers send text messages that appear to be from trusted organizations, urging recipients to click on a link or call a phone number. These messages often create a sense of urgency, such as claiming your account will be locked if you don’t respond immediately. The goal is to get you to disclose personal information or install malicious software on your phone.

Vishing

This method involves phone calls. The term combines “voice” and “phishing.” In a vishing attack, the scammer calls you, often pretending to be from a trusted organization such as:

- A bank

- A tech support

- A government agency

They might tell you there’s a problem with your account or that you need to verify some information. The caller might use caller ID spoofing to make it appear as though they are calling from a legitimate number. Their goal is to trick you into providing sensitive information or making a payment.

How to recognize vishing?

Vishing scams can be tricky to spot because they often seem like legitimate phone calls from trusted sources. Here are some tips to help you recognize vishing attempts:

Unexpected Calls

Be cautious if you get an unsolicited call asking for personal or financial information. Remember that legitimate organizations rarely request sensitive information over the phone without prior contact.

Urgency and Fear

Scammers often create a sense of urgency or fear to pressure you into making quick decisions. They might claim there’s a problem with your bank account, or that you owe money to the government. This urgency is a form of tactic to make you act without thinking.

Request for Sensitive Information

Hold back if the caller asks for personal details like:

- Social security numbers

- Bank account information

- Passwords

It’s likely a scam. Legitimate companies never request this information over the phone.

Caller ID Spoofing

Scammers can make it appear as though they’re calling from a trusted number, such as your bank or a government agency. Even if the number looks familiar, be cautious of any unsolicited calls.

Poor Call Quality and Unprofessional Behavior

Calls that have poor audio quality or come from representatives who sound unprofessional can be a sign of a scam. Legit businesses typically maintain professional conduct during phone calls.

Unusual Payment Requests

If the caller asks for payment through unconventional methods, like gift cards or wire transfers, drop the call. Trusted companies will never ask for payments in these forms.

Verify the Caller

Always take the time to verify the caller’s identity. Hang up and call the organization directly using a phone number from their official website. Do not use any numbers provided by the caller.

Repeated Calls

Receiving multiple calls from the same number, especially if the caller is aggressive or persistent, is often a sign of a scam. Report these numbers to your phone carrier or a relevant authority.

11 common vishing scams

Vishing scams use deceptive phone calls to trick people into giving away personal information. These are the common scams to help you recognize and avoid them:

1. Bank Fraud Calls

Scammers pose as bank representatives, claiming suspicious activity on your account. They ask for your account number, PIN, or other sensitive information to “verify” your identity. Real banks never ask for this information over the phone.

2. Tech Support Scams

These scammers pretend to be from tech support, often claiming there is a virus on your computer. They ask for remote access to fix the problem, which gives them control over your device and access to your personal information.

3. Government Impersonation

Posing as officials from tax agencies or other government bodies, scammers claim you owe money or face legal action. They use fear and urgency to pressure you into paying fines or revealing sensitive information.

4. Lottery Winnings

You receive a call informing you that you’ve won a lottery or prize. To claim it, you must provide bank details or pay a fee. Legitimate lotteries don’t ask for money upfront to release winnings.

Read more: Beware of the lottery scams

5. Charity Scams

Scammers exploit your goodwill by pretending to be from charities, often after natural disasters or during holidays. They ask for donations, which go directly into their pockets. Verify charities before donating.

6. Debt Collection

Fraudsters claim you have unpaid debts and threaten legal action or arrest if you don’t pay immediately. They often demand payment through unconventional methods like gift cards or wire transfers.

7. Healthcare Scams

Pretending to be from health insurance companies or medical providers, these scammers offer fake services or claim there’s an issue with your policy. They ask for personal information or payments to “fix” the problem.

8. Customer Service Impersonation

Scammers call pretending to be from well-known companies, stating there’s an issue with your account or order. They request your login details or credit card information to “resolve” the issue.

9. Job Offer Scams

Fraudsters offer fake job opportunities, requiring you to provide personal details or pay upfront for training or materials. Always research job offers and contact the company directly through official channels.

10. Utility Company Scams

Claiming to be from your utility provider, scammers state that you have an overdue bill and threaten to cut off services unless you pay immediately. Utility companies usually send multiple notices before taking such action.

11. Family Emergency Scams

Scammers pretend to be a relative in trouble or claim a family member is in danger, needing immediate financial help. Verify the situation by contacting other family members before taking any action.

How to avoid phishing attacks?

Phishing attacks can result in identity theft and financial loss. Here are some tips and tools to help you stay safe from these kinds of attacks:

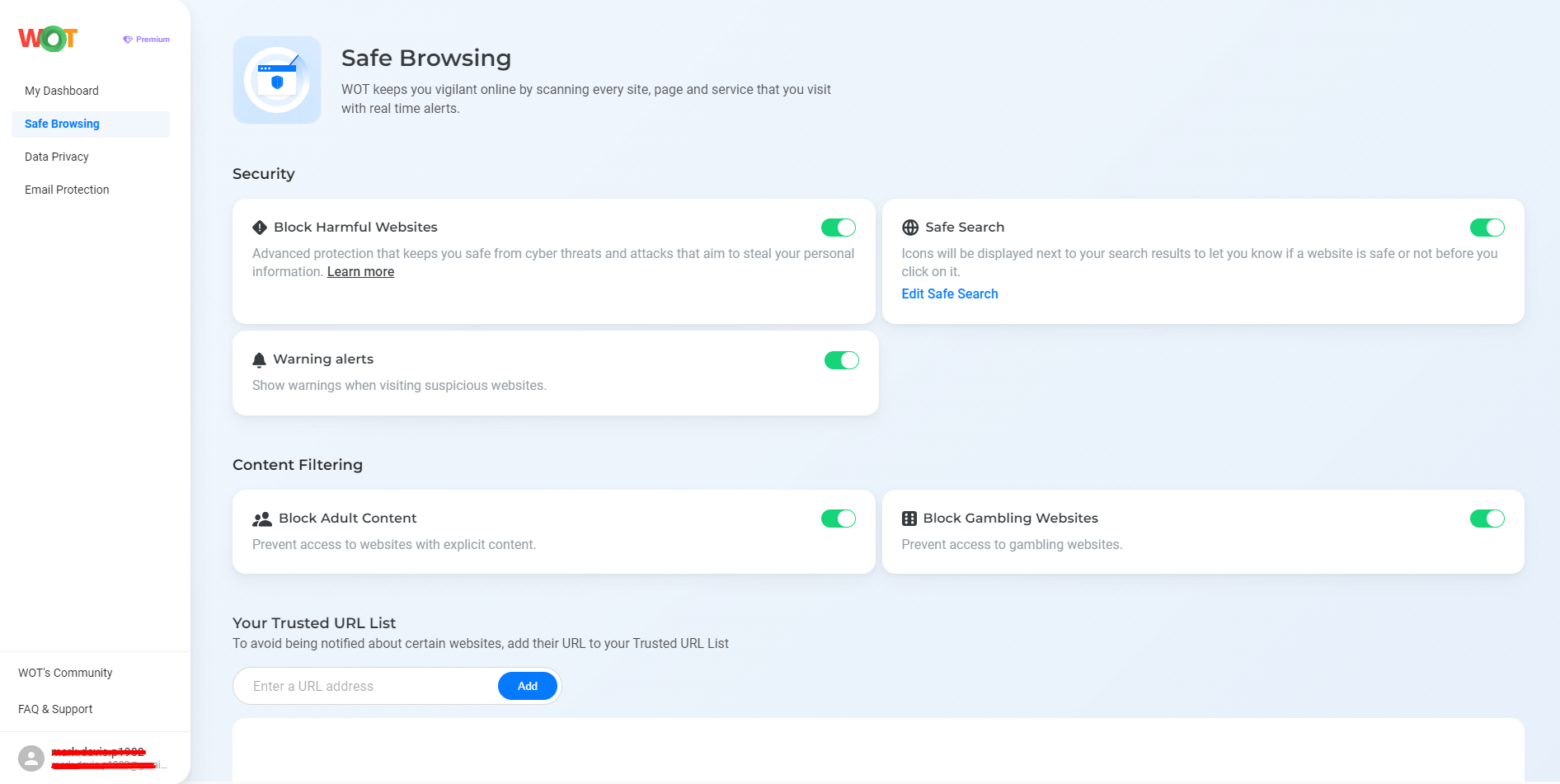

1. Use the WOT Browser Extension and App

The WOT browser extension and app alerts you about suspicious websites. It uses community ratings and reviews to warn you if a site is known for phishing or other malicious activities.

Before clicking any link, check the WOT rating to see if the site is trustworthy. This can be very helpful for spotting fake websites designed to steal your information.

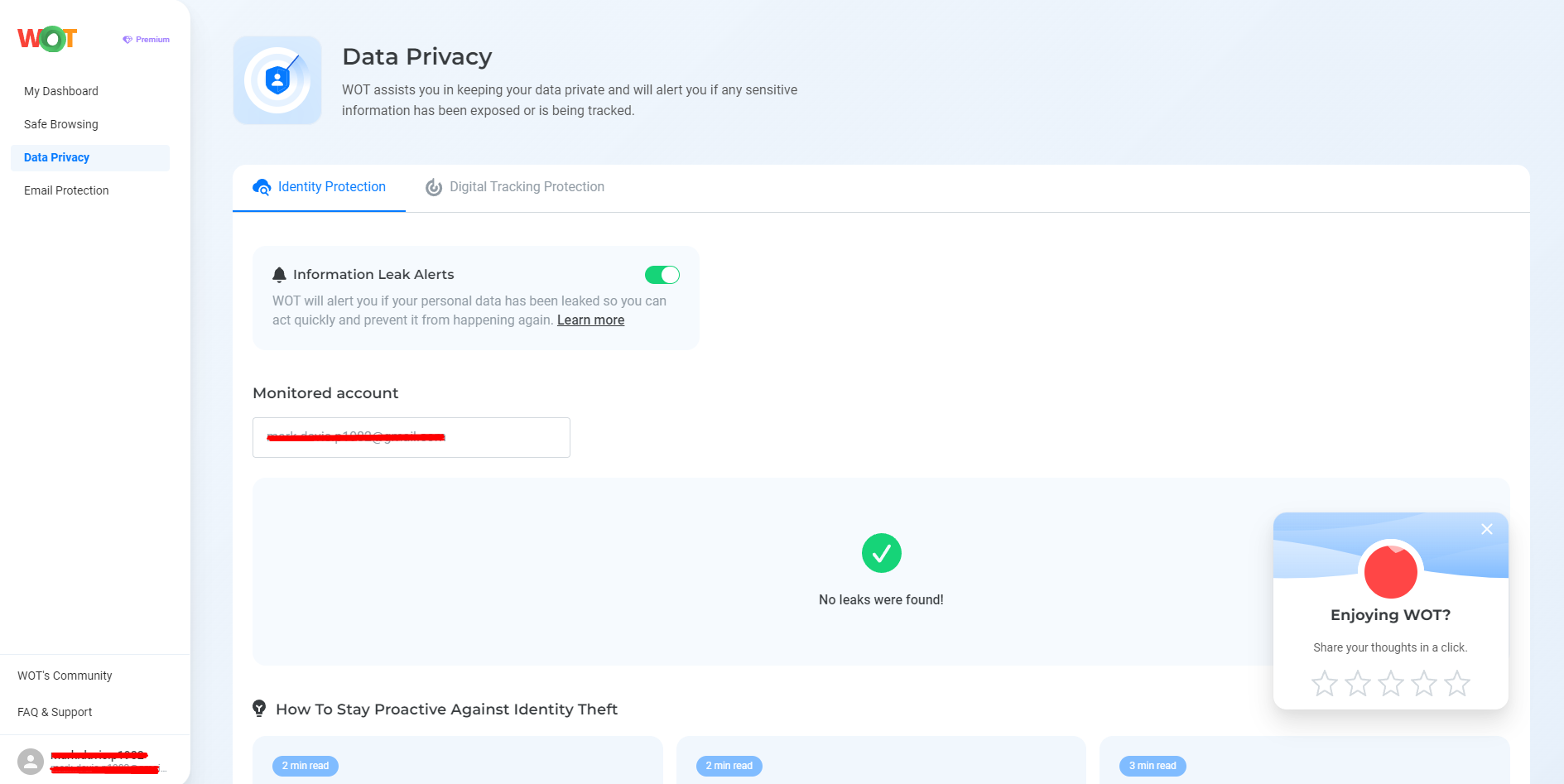

In addition, it also has a Data Privacy feature, which will alert you if your personal data has been leaked so you can immediately take action.

2. Verify Caller Identity

If you get a call asking for personal information, immediately hang up and call back using a number from the official website of the organization. This way, you can make sure you are talking to a legitimate representative and not a scammer.

3. Avoid Sharing Personal Information

Be careful about sharing personal information over the phone or online. Scammers often pose as legitimate entities to collect sensitive details.

4. Stay Informed

Keep yourself informed about the latest phishing scams by reading news from trusted cybersecurity sites where authors share and warn about new threats. You should read about cybersecurity FAQs so you can recognize and avoid phishing attempts more effectively.

5. Install Call-Blocking Apps

Call-blocking apps can help filter out unwanted and suspicious calls. These apps use databases of known scam numbers to block them before they reach you.

6. Report Suspicious Calls

Reporting suspicious calls to authorities can help track and prevent scams. Many phishing attempts rely on high volume, so reporting can reduce the number of potential victims..

7. Educate Yourself and Others

Sharing knowledge about phishing tactics and prevention methods can protect not only yourself but also your friends and family. Take advantage of social media to help spread awareness about online safety.

The Importance of Being Alert and Informed

Being alert and informed is your best defense against vishing attacks. Scammers keep changing their methods, so it’s important to recognize the signs of vishing. Tools like the WOT browser extension and app can enhance your protection by warning you of suspicious websites and phone numbers.

Regularly update your knowledge about common scams and follow best practices to avoid falling victim to these tricks. With these steps, you can protect your personal and financial information from vishing attacks.

FAQs

What should I do if I receive a vishing call?

If you get a vishing call, stay calm and don’t give out any personal information. Hang up immediately. If the caller claims to be from a known organization, contact that organization directly using a number from their official website to verify the call. Always report suspicious calls to your local authorities or cybersecurity organizations. This helps track and potentially stop these scammers.

Can vishing attacks occur on mobile phones?

Yes, vishing attacks can happen on both mobile phones and landlines. Scammers use various techniques to mask their numbers, making it look like they’re calling from a trusted source. Mobile phones are particularly vulnerable because many people rely heavily on them for personal and professional communication.

What are some signs of a vishing attack?

Common signs of a vishing attack include unexpected calls asking for personal information, the caller creating a sense of urgency or fear, and requests for sensitive details like social security numbers, passwords, or credit card information. These calls often come from spoofed numbers that mimic legitimate businesses or government agencies. If something feels off or too urgent, it’s likely a scam.

How can businesses protect employees from vishing?

Businesses can protect their employees by conducting regular security awareness training. Educate employees about the risks of vishing and the common tactics used by scammers. Implement strict policies on sharing personal or company information over the phone. Using caller ID verification and call-blocking technologies can also help filter out suspicious calls before they reach employees.

Are vishing attacks on the rise?

Yes, vishing attacks have been increasing significantly. With more people working remotely and relying on phone communication, scammers are exploiting this trend. Reports from GSMA show that in 2023, hybrid vishing attack rates have surged by 554%. This is why staying informed and cautious is the best defense against this growing threat.